The allure of cryptocurrency mining, particularly Bitcoin, Ethereum, and even Dogecoin, dangles a promise of lucrative returns. Visions of passive income streams and digital gold rushes fill the minds of prospective investors. But beneath the glittering surface lies a complex web of variables that can drastically impact profitability. Understanding these intricacies is paramount before committing substantial capital to mining ventures.

At the heart of mining investment lies the mining rig itself. These specialized machines, often referred to as ASICs (Application-Specific Integrated Circuits) for Bitcoin mining or GPU-based rigs for Ethereum and other altcoins, represent a significant upfront cost. The initial price tag can range from a few thousand dollars to tens of thousands, depending on the hashing power, energy efficiency, and availability. Furthermore, the rapid technological advancements in mining hardware render older models obsolete quickly, necessitating periodic upgrades to remain competitive. This depreciation factor must be carefully considered in any ROI calculation.

Beyond the hardware costs, electricity consumption is a major recurring expense. Mining rigs consume substantial amounts of power, and electricity prices vary significantly across regions. Locations with cheap and reliable energy sources, often near hydroelectric dams or geothermal plants, offer a distinct advantage. The profitability equation hinges on securing access to affordable power; otherwise, the electricity bill can easily erode mining rewards.

The cryptocurrency market’s inherent volatility adds another layer of complexity. The value of Bitcoin, Ethereum, and other mineable currencies can fluctuate wildly, impacting the dollar value of the mined coins. A sudden price drop can render a previously profitable mining operation unprofitable overnight. Therefore, risk management strategies, such as hedging or diversifying into multiple cryptocurrencies, are essential to mitigate market risk.

Mining difficulty, a dynamic parameter that adjusts based on the network’s overall hashing power, further complicates matters. As more miners join the network, the difficulty increases, making it harder to solve cryptographic puzzles and earn rewards. This necessitates more powerful hardware and higher energy consumption to maintain a consistent mining output. The interplay between mining difficulty, network hash rate, and individual miner hash rate directly affects profitability.

Choosing between solo mining and joining a mining pool is another crucial decision. Solo mining offers the potential for larger rewards but requires significant computational resources and comes with a high degree of luck. Mining pools, on the other hand, aggregate the hashing power of multiple miners, increasing the chances of solving blocks and earning regular payouts, albeit smaller ones. The optimal choice depends on the investor’s risk tolerance and available resources.

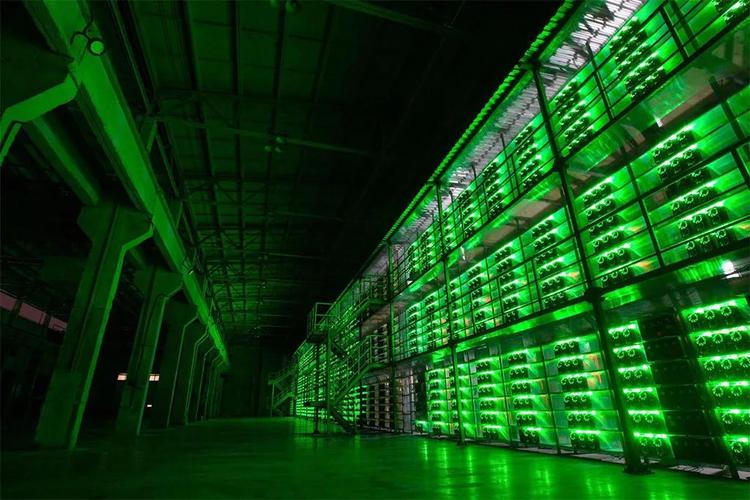

Mining machine hosting, an increasingly popular alternative, offers a solution to some of the challenges associated with home-based mining. Hosting providers offer secure facilities with stable power supplies, optimized cooling systems, and technical support. While hosting fees add to the overall cost, they can alleviate the burden of managing hardware, monitoring performance, and dealing with power outages. Choosing a reputable and reliable hosting provider is crucial for ensuring uptime and maximizing returns.

The regulatory landscape surrounding cryptocurrency mining is constantly evolving. Governments worldwide are grappling with how to regulate mining activities, and potential tax implications can significantly impact profitability. Staying informed about the latest regulations and tax laws is essential for compliance and avoiding legal pitfalls.

Successfully navigating the complexities of mining investment returns requires a thorough understanding of hardware costs, electricity prices, market volatility, mining difficulty, network dynamics, hosting options, and regulatory considerations. A comprehensive financial model that incorporates these variables is essential for assessing the potential ROI and making informed investment decisions. Furthermore, continuous monitoring and adaptation are crucial for maximizing profitability in the ever-changing cryptocurrency landscape. The dream of passive income through mining is attainable, but only with careful planning, diligent execution, and a healthy dose of realism.

Finally, the environmental impact of cryptocurrency mining, particularly Bitcoin, is an increasingly pressing concern. The energy-intensive nature of Proof-of-Work (PoW) mining has drawn criticism for its carbon footprint. As a result, there’s a growing movement towards more energy-efficient consensus mechanisms, such as Proof-of-Stake (PoS), and the adoption of renewable energy sources for mining operations. Investors should consider the environmental implications of their mining activities and explore ways to minimize their impact.

This article dives into the intricate landscape of mining investments, unraveling factors like market volatility, regulatory challenges, and environmental impacts. It offers insightful strategies to maximize returns while balancing ethical considerations, making it a must-read for both novices and seasoned investors.