Singapore, a global hub for finance and technology, is increasingly becoming a focal point for the burgeoning cryptocurrency mining industry. The island nation’s stable political climate, robust infrastructure, and forward-thinking regulatory environment provide a fertile ground for businesses looking to capitalize on the digital asset revolution. Central to this burgeoning industry are high-performance ASIC (Application-Specific Integrated Circuit) miners, the workhorses responsible for securing blockchain networks and generating cryptocurrency rewards. But what makes these machines tick, and why are they gaining traction in Singapore?

ASIC miners represent the pinnacle of specialized computing hardware. Unlike general-purpose CPUs or GPUs, ASICs are designed from the ground up to perform a single, very specific task – in this case, the cryptographic hashing algorithms that underpin cryptocurrencies like Bitcoin. This laser-like focus allows them to achieve significantly higher hash rates (the speed at which they perform calculations) and energy efficiency compared to other types of hardware. In the cutthroat world of crypto mining, speed, efficiency, and reliability are paramount, making ASIC miners the preferred choice for serious operators.

The allure of ASIC miners stems from their ability to maximize profitability in a competitive landscape. Consider Bitcoin, the original and most valuable cryptocurrency. Mining Bitcoin involves solving complex mathematical puzzles to add new blocks to the blockchain and earn block rewards. As the network’s hash rate increases, the difficulty of these puzzles also rises, demanding ever-more powerful hardware. ASIC miners provide the necessary computational muscle to stay ahead of the curve, allowing miners to compete for rewards and contribute to the network’s security.

However, the landscape is constantly evolving. The rise of other cryptocurrencies has diversified the mining ecosystem. While Bitcoin remains the dominant force, altcoins like Ethereum (before its transition to Proof-of-Stake) and Dogecoin have also attracted significant mining interest. Each cryptocurrency utilizes a different hashing algorithm, requiring different types of ASIC miners. For instance, Ethereum previously relied on the Ethash algorithm, while Dogecoin utilizes Scrypt. This necessitates a strategic approach to hardware selection, taking into account the profitability of each cryptocurrency, the cost of electricity, and the overall mining difficulty.

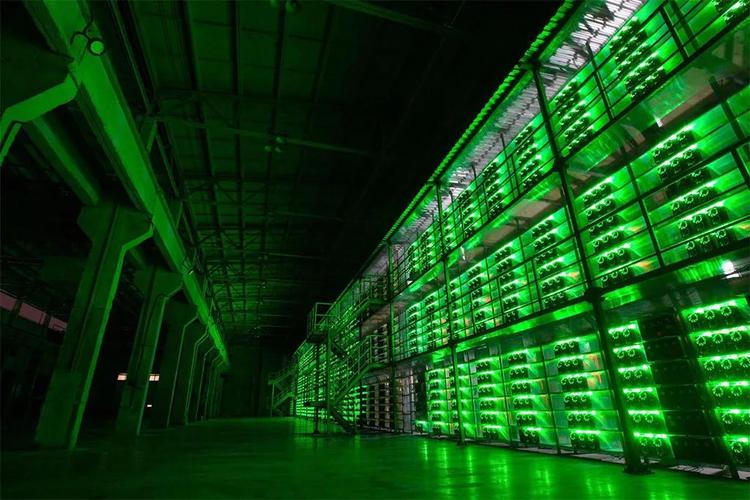

Singapore’s appeal as a mining hub extends beyond its favorable regulatory climate. The nation’s state-of-the-art infrastructure, including reliable power grids and high-speed internet connectivity, is crucial for ensuring the smooth operation of mining facilities. Mining machines consume vast amounts of electricity, and any downtime can result in significant financial losses. Singapore’s commitment to technological innovation and its proactive approach to energy management make it an attractive location for hosting mining operations.

The concept of mining machine hosting is also gaining popularity. Instead of setting up and managing their own mining facilities, individuals and businesses can entrust their ASIC miners to specialized hosting providers. These providers offer secure, climate-controlled environments, reliable power supplies, and expert technical support, allowing miners to focus on optimizing their mining strategies without the hassle of infrastructure management. Singapore boasts a number of reputable mining hosting providers, further solidifying its position as a key player in the global mining industry.

The cryptocurrency market is notoriously volatile, and mining is not without its risks. The price of cryptocurrencies can fluctuate dramatically, impacting the profitability of mining operations. Furthermore, the rapid pace of technological advancement means that ASIC miners can become obsolete relatively quickly, requiring ongoing investments in new hardware. Careful risk management and a thorough understanding of the market dynamics are essential for success in this industry. Despite these challenges, the potential rewards are significant, and Singapore is well-positioned to capitalize on the continued growth of the cryptocurrency mining sector.

Beyond Bitcoin, Ethereum, and Dogecoin, the world of cryptocurrencies extends to a vast array of alternative coins, each with its own unique characteristics and mining requirements. Some altcoins are designed to be ASIC-resistant, meaning that they are specifically engineered to make it difficult or impossible to mine them using specialized hardware. This is often done to promote decentralization and prevent large-scale mining operations from dominating the network. However, the constant cat-and-mouse game between developers and miners ensures that the landscape is constantly shifting, with new mining opportunities emerging and disappearing all the time.

The environmental impact of cryptocurrency mining is also a growing concern. The energy-intensive nature of mining operations has raised questions about their sustainability, particularly in regions that rely on fossil fuels for electricity generation. However, there is a growing movement towards utilizing renewable energy sources to power mining facilities, reducing their carbon footprint and promoting a more sustainable approach to cryptocurrency mining. Singapore, with its commitment to green technologies and its emphasis on energy efficiency, is well-placed to lead the way in this regard.

In conclusion, the world of high-performance ASIC miners in Singapore is a dynamic and rapidly evolving landscape. The island nation’s robust infrastructure, forward-thinking regulatory environment, and commitment to technological innovation make it an attractive location for businesses looking to capitalize on the cryptocurrency revolution. While mining is not without its risks and challenges, the potential rewards are significant, and Singapore is well-positioned to remain a key player in the global mining industry.

Singapore mines ASIC gold! Efficiency soars, speed blazes, and reliability reigns. A deep dive into crypto-powering rigs, promising peak performance. Is this the future?